This trade is vital to the exactness of your business’s financial records and reports. Particular exchanges influence capital to incorporate the buy, revaluation, devaluation, and sale of the asset.

#Net fixed asset turnover formula manual

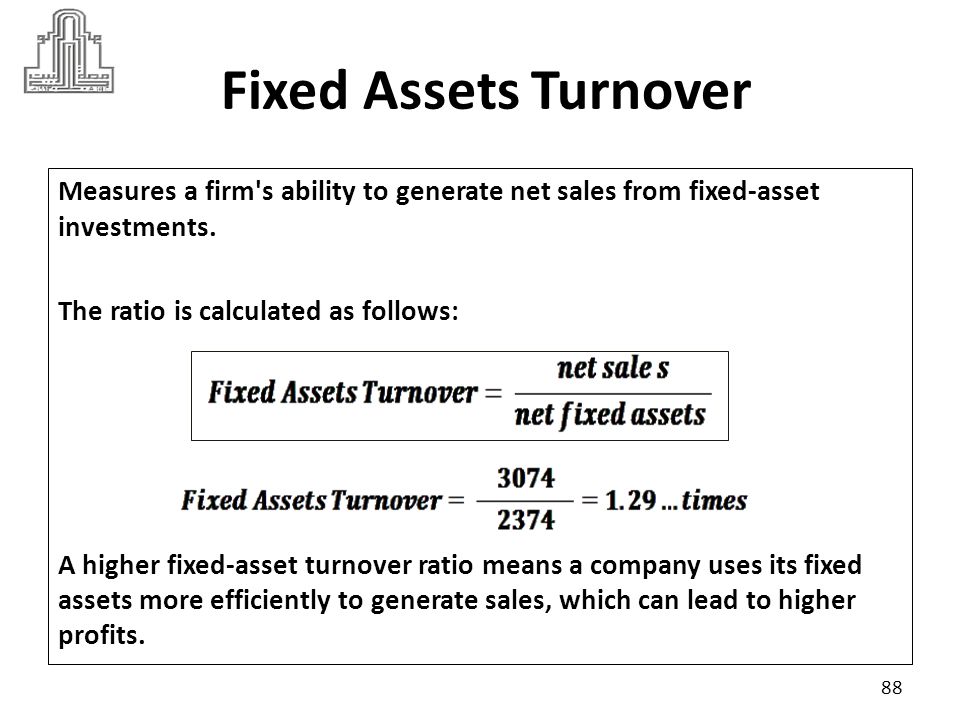

If your business has fixed assets, sound accounting standards can fill in as a manual for properly representing these long-haul goods on your bookkeeping records. This fixed asset is useful in calculating the overall revenue of the company.ĭifferent Types of fixed assets Accounting For Fixed Asset 25 lakhs, and this will also reflect in their balance sheet. Thus, ABC firm acquired a fixed asset worth Rs. This can be furniture, engine vehicles, PCs, and much more. Thus ABC firm will now have a place from where they can maintain their business operation and are solely responsible for the building as well.įixed assets additionally incorporate any property that the organization doesn’t sell directly to the customer. The building has a physical shape, will last longer than a year, and creates income, making it a fixed asset. Let’s consider that ABC firm plans to purchase an office worth 20 lakhs rupees. The word “fix” indicates that these assets won’t be sold in the current bookkeeping year. A typical case of fixed assets is a producer’s plant resources, for example, its structures and hardware. Commonly Asked Questions On Fixed AssetsĪ fixed asset is a long-term part of a property that a company possesses and utilizes in the generation of its revenue and is not anticipated that would be devoured or consumed into cash in the coming next year.What is the Fixed Asset Turnover Ratio?.

0 kommentar(er)

0 kommentar(er)